nh meals tax calculator

Meals paid for with food stampscoupons. 4 Specific sales tax levied on accommodations.

Great Bay Food Truck Festival Town Of Stratham Nh

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

. State has no general sales tax. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for. Nh Food Tax Calculator.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Use this app to split bills when dining with friends or to verify costs of an individual purchase. New Hampshire has a 0 statewide sales tax rate and does not allow local.

The state does tax income from interest and. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

Enter your info to see your take home pay. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forwardThe state meals and rooms tax is.

While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. This tax is only paid on income from these sources that is 2400. Nh meals tax calculator.

2022 New Hampshire state sales tax. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. A calculator to quickly and easily determine the tip sales tax and other details for a bill.

Some schools and students. Please note that effective October 1 2021 the Meals Rentals Tax rate is. New Hampshire is one of the few states with no statewide sales tax.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. Exact tax amount may vary for different items.

For additional assistance please call the Department of Revenue Administration at 603. NH EASY Gateway to Services New Hampshires Electronic Application System. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms.

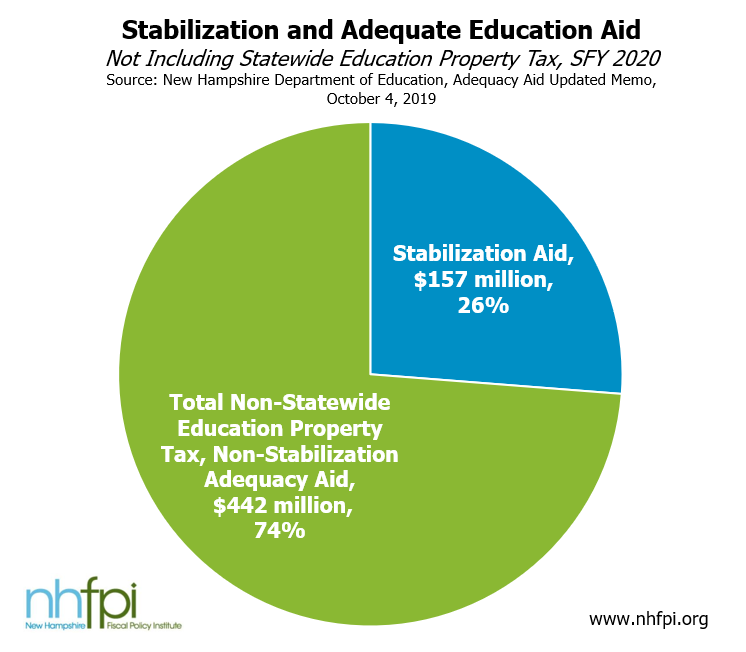

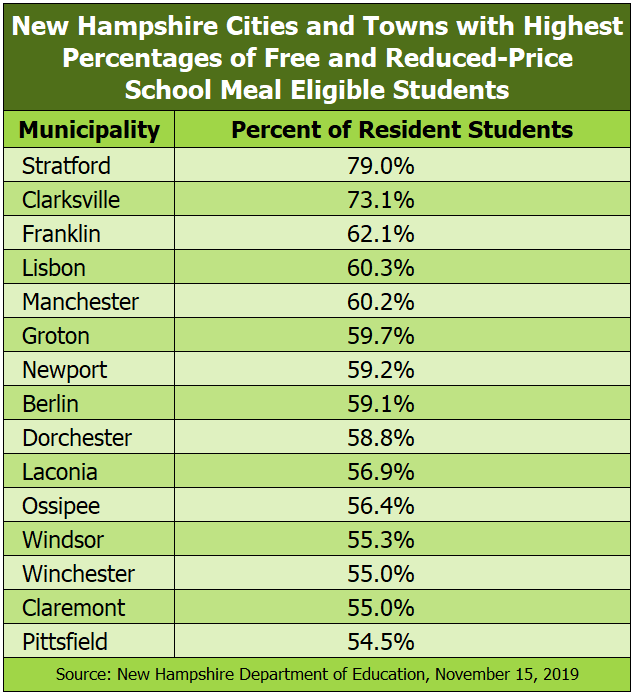

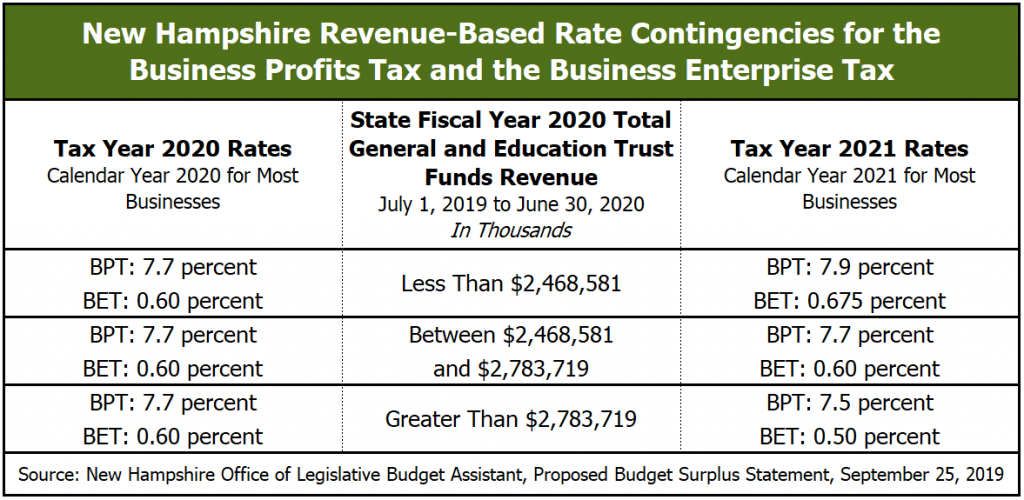

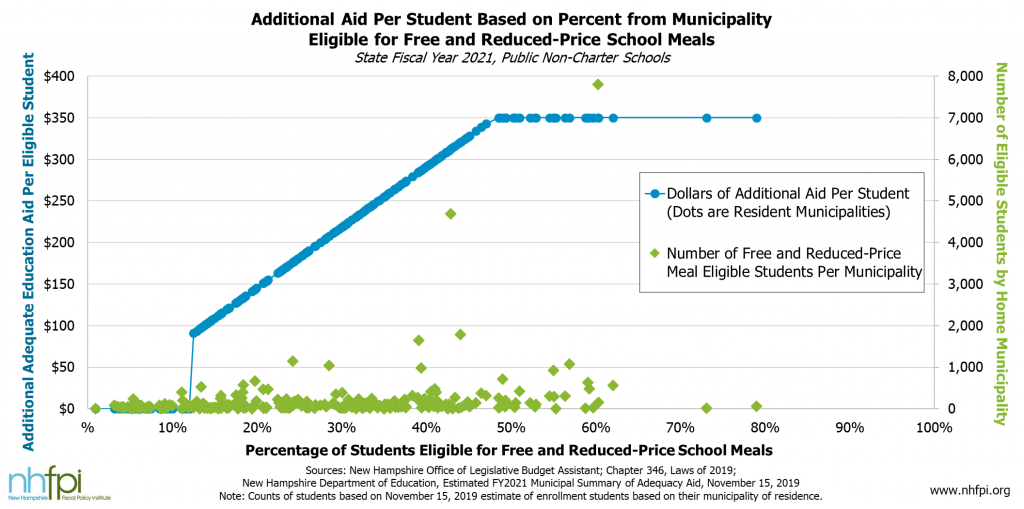

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

New Hampshire Sales Tax Rate 2022

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

State And Local Sales Tax Calculator

4 Ways To Calculate Sales Tax Wikihow

New Hampshire Sales Tax Handbook 2022

Sales Tax By State To Go Restaurant Orders Taxjar

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Parks Recreation News Announcements Town Of Stratham Nh

2021 Taxes And New Tax Laws H R Block

New Hampshire Paycheck Calculator Smartasset

States With No Sales Tax What You Need To Know

Inflation Spike Hits 30 Year Record And The Biden Agenda Nh Journal

Free Llc Tax Calculator How To File Llc Taxes Embroker

New Hampshire Income Tax Nh State Tax Calculator Community Tax